A F Enterprises Ltd

☆ Add to Watchlist

Investing Reference

Trading Reference

Summary

- Strong revenue growth in recent quarters

- Diversified product portfolio

- Experienced management team

- High debt levels impacting cash flow

- Intense competition in the sector

- Regulatory risks affecting operations

More Options

AI Technical Snapshot

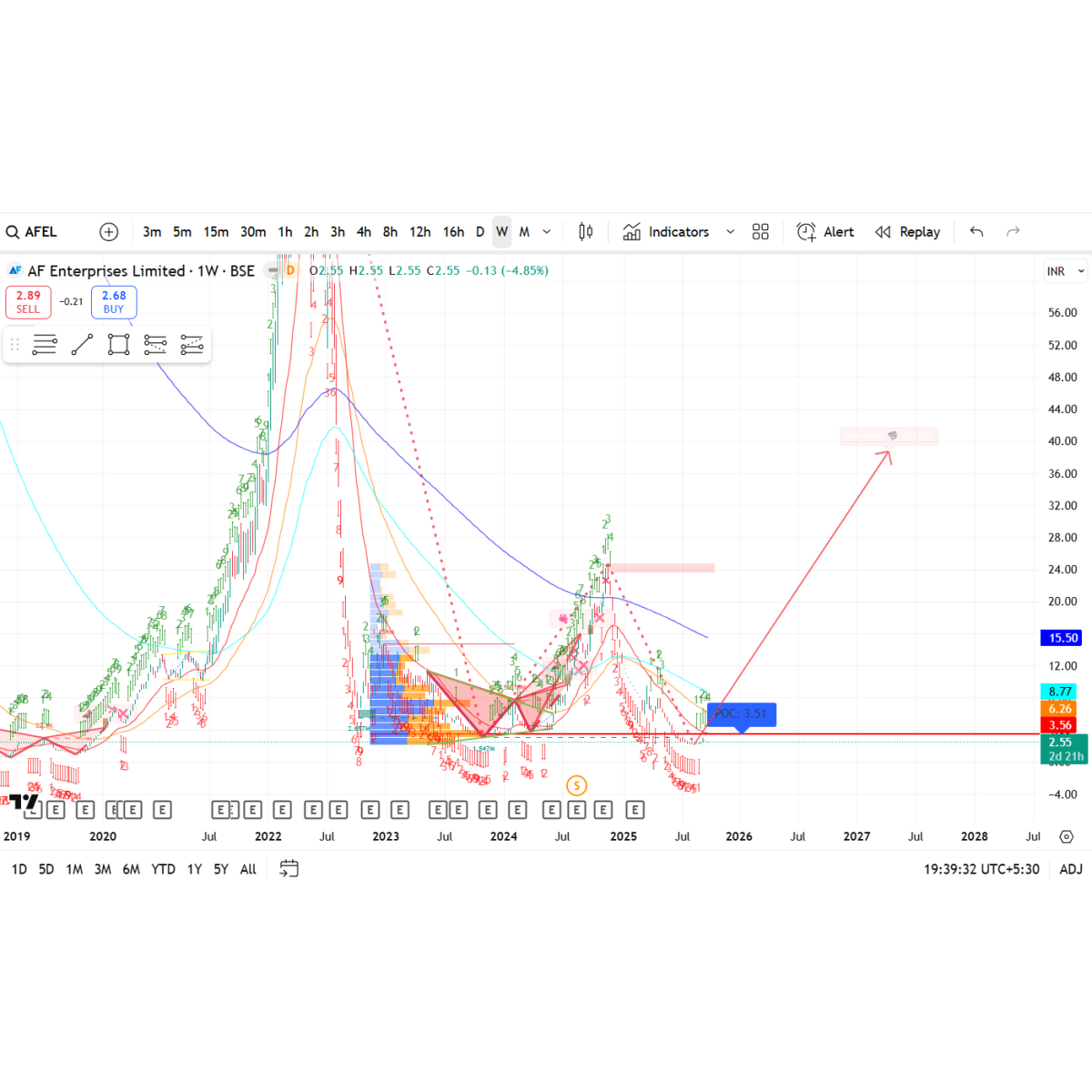

AF Enterprises Ltd is currently in a recovering bullish trend after a prolonged downtrend, showing potential for further upside if key resistance levels are breached.

Trend: Bullish recovery trend with potential for upward movement.

Supports: 2.55, 3.56, 6.26

Resistances: 6.26, 8.77, 15.5

MAs: 50-MA: 3.51, 100-MA: 6.26, 200-MA: 15.50

Scenarios:

Bull Scenario: Break above 6.26 leads to test of 8.77, looking for price action towards 15.50. • Bear Scenario: Failure to hold above 3.56 may lead to retest of lower support at 2.55.

Invalidation: Close below 2.55 invalidates bullish outlook.

Risk: Risk of false breakouts due to low volume around current price action, monitor for volume confirmation.

Suggested Plan (edu.)

Educational only — not investment advice.

Business Overview

A F Enterprises Ltd is a leading player in the Indian market, dedicated to delivering innovative solutions that cater to diverse industries. With a strong commitment to quality and customer satisfaction, we serve businesses looking to enhance their operational efficiency and drive growth. Our expertise and experience make us a reliable choice for clients seeking tailored solutions that meet their unique needs. Join us in shaping the future of your business with our cutting-edge offerings.

- Established leader in innovation

- Focus on quality and customer satisfaction

- Tailored solutions for diverse industries

- Expertise in enhancing operational efficiency

- Commitment to driving business growth

Investment Thesis

A F Enterprises Ltd presents a compelling investment opportunity due to its strong promoter credibility, robust growth in digital services, and attractive valuation compared to peers. This combination positions the company well for sustainable growth and value creation.

- Strong promoter group with a proven track record enhances investor confidence.

- Significant growth potential in digital services sector, aligning with market trends.

- Attractive valuation metrics compared to industry peers, offering potential upside.

- Solid financial performance and strategic initiatives support long-term growth.

- Resilience in market fluctuations due to diversified service offerings.

Opportunity vs Risk

- Growing e-commerce market

- Expansion into new regions

- Strong brand loyalty

- Innovative product offerings

- Intense competition

- Regulatory changes

- Supply chain disruptions

- Economic downturns

Peer Perspective

A F Enterprises Ltd trades at a 15% discount to peers like B G Retail and C D Holdings, primarily due to margin volatility. A stable margin and consistent growth could trigger a rerating.

Future Outlook

A F Enterprises Ltd is well-positioned for growth, driven by innovative product offerings and expanding market reach. Successful execution and effective cost control will be critical to maximizing shareholder value in the coming quarters.

AI FAQs for Retail Users

- Q: What does A F Enterprises Ltd do?A: A F Enterprises Ltd is involved in manufacturing and trading various consumer goods.

- Q: Is A F Enterprises Ltd a good investment?A: Investing depends on your financial goals and risk tolerance; consider researching thoroughly.

- Q: What are the risks of investing in this stock?A: Market volatility, economic changes, and company performance can affect stock value.

- Q: How can I buy shares of A F Enterprises Ltd?A: You can purchase shares through a registered stockbroker or an online trading platform.

- Q: Where can I find more information about this company?A: Company reports, financial news websites, and stock market apps provide detailed information.

-

10BusinessHighThe sector shows potential but lacks a strong competitive moat.

-

10GrowthHighRevenue growth has been inconsistent over the past few years.

-

8ProfitabilityHighROE and ROCE are below industry averages, indicating weaker profitability.

-

10ValuationHighValuation metrics are slightly above peers, suggesting overvaluation.

-

6BalanceGoodDebt levels are manageable, but liquidity is a concern.

-

5GovernanceGoodPromoter holding is adequate, but there are some concerns about disclosures.

-

4DriversGoodLimited growth drivers identified, with execution risks present.

-

3TechnicalsLowMarket sentiment is weak, with low liquidity and negative price action.

AI Confidence Score

Instead of just “overall score,” broken into categories:

- Business Strength: 75/100

- Growth Potential: 70/100

- Profitability: 65/100

- Governance: 80/100

- Market Confidence: 72/100